Sephora Credit Card Review

Sephora recently launched the Sephora Credit Card and the Sephora Visa Credit Card issued by Comenity Bank to help shoppers earn more rewards. Should you get a Sephora credit card?

There are three cards:

Sephora Credit Card

Sephora Visa Credit Card

Sephora Visa Signature Credit Card ($5,000+ credit limit)

If you apply for the Visa credit card and you’re approved for a credit limit over $5,000, it will be the Visa Signature edition. In addition to earning credit card rewards, you’ll also have access to Beauty Insider Benefits.

Before we dive into key features of each card, there is some fine print that applies to all of the cards.

The Fine Print

Reward Dollars Expire - Rewards Dollars will expire 18 months after the date that they’re posted to your account: https://d.comenity.net/sephoravisa/pub/benefits/benefits/Benefits.xhtml

Rewards Dollars are essentially “points” you accumulate towards a redemption

Redemption Rates - Credit Card Rewards can only be redeemed for a specified dollar amount off qualifying purchases at Sephora stores located in the U.S. only and at sephora.com. Excludes Sephoras located inside JC Penny retail stores.

Minimum Rewards Redemption - The minimum rewards balance you must have to redeem is $125 Rewards Dollars

Once you accumulate $125 Rewards Dollars, you’ll be issued a $5 Credit Card Reward

$125 Rewards Dollars = $5 Credit Card Reward

Credit Card Rewards Expire - You have 90 days to use the Credit Card Rewards from the issue date, or they will expire.

Redeeming Credit Card Rewards - You can only stack credit card rewards in-store only, and not online. If the purchase amount is greater than the Credit Card Rewards amount, you must use the Sephora store card or credit card for the remaining balance.

If your purchase is LESS than the Credit Card Reward being used, then any remaining value of the Credit Card Reward will be forfeited.

Credit Card Rewards cannot be redeemed for gift cards or gift certificates, eGift cards, FLASH, PLAY! by Sephora, monogramming, gift wrap, taxes, shipping and processing fees or on delivery surcharges.

Excludes Sephoras located inside JC Penny - You will not earn 4% on purchases from a Sephora located inside JC Penny

Sephora Credit Card (Store Only)

The Sephora Credit Card is a store only card, meaning that it can only be used at Sephora stores.

Key Highlights

15% off your first card purchase at Sephora

Earn 4% on Sephora purchases in-store or online

No annual fee

Sephora Visa Credit Card & Visa Signature Credit Card

The Sephora Visa Credit Card can be used at Sephora and anywhere that takes Visa.

Key Highlights

15% off your first card purchase at Sephora

“Welcome Offer”: $20 Sephora Credit Card Reward after spending $500 outside Sephora within the first 90 days of account opening

Earn 4% on Sephora purchases in-store or online

Earn 1% on all other purchases outside Sephora

No annual fee

Emergency card replacement, lost/stolen card reporting

Zero liability

Auto rental coverage & roadside dispatch

Tap to pay

Alternative Options

The Sephora credit cards might seem like an average store card at first glance, but once you dive into the fine print, the card is not for the casual shopper. Credit Card Rewards expire 90 days from issue date, so the card is ideal for people who spend a significant amount at Sephora each month.

For casual shoppers, there are a handful of alternative credit cards that have better welcome offers and competitive cashback rates.

If you’re someone who has access to a Sephora inside a JC Penny, consider getting the U.S. Bank Cash+ instead to earn 5% on Sephora purchases. The card earns 5% cash back at department stores, including JC Penny. Furthermore, you’ll earn $150 cash back for spending $500 within the first 3 months of account opening — much better than earning $20 in rewards that can only be redeemed at Sephora.

U.S. Bank Cash+

Annual fee: $0

Welcome bonus: $150 after $500 in spend within the first 90 days of account opening

Spending Multipliers:

Earn 5% cash back on the first $2,000 in purchases each quarter on the two categories you choose

Earn 2% cash back on your choice of an everyday category like gas stations or grocery stores

Earn 1% cash back on all other purchases

Another option is the Chase Freedom card that has rotating 5% cash back categories each quarter you activate. Chase cards have access to the Chase Shopping Portal where you can earn 4% back at Sephora. Rates are subject to change.

Chase Freedom

Annual fee: $0

Welcome bonus: $150 after $500 in spend within the first 90 days of account opening

Spending Multipliers:

Earn 5% cash back on rotating categories each quarter you activate, up to $1,500 in combined purchases

Earn 1% cash back on all other purchases

Online Shopping Portals

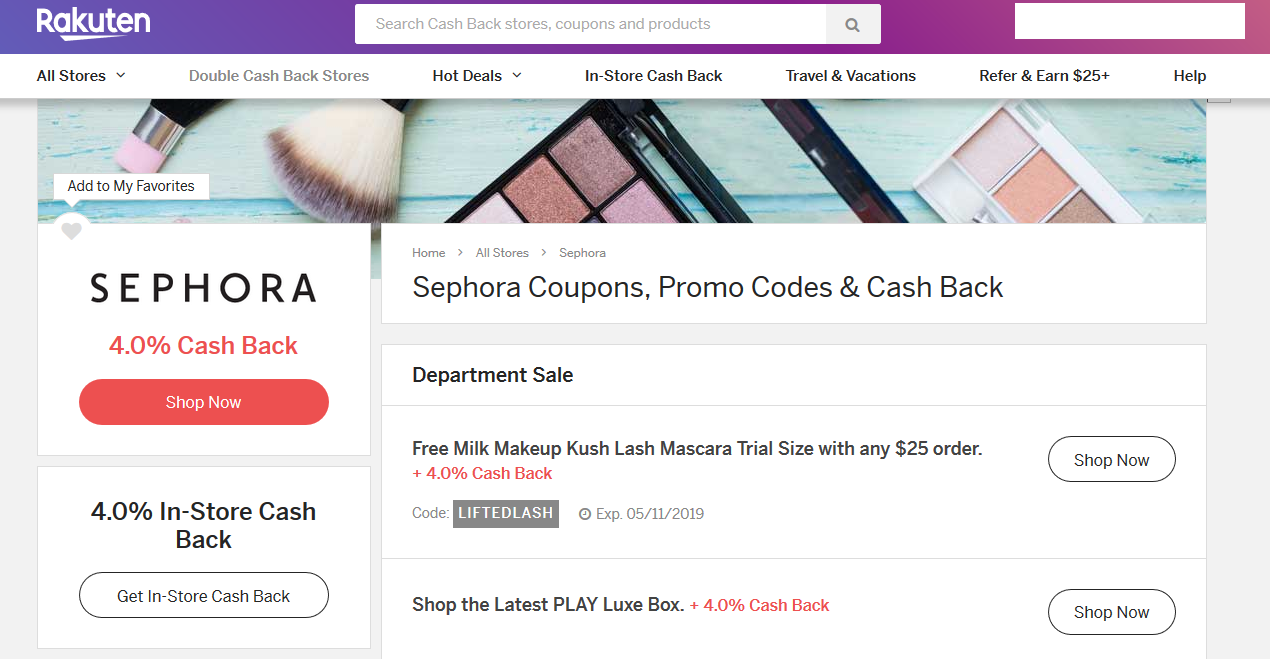

If you’re not interested in adding another credit card, the best way to optimize cash back at Sephora purchases is to shop through an online shopping portal like Ebates.

Ebates typically earns 4% cash back, and there are often promotional periods where it goes up to 10-15%.

Sign up for Ebates get a $10 Welcome Bonus after you join for free and place your first purchase of $25 or more (referral link): http://bit.ly/2IMlIFJ